What is fintech marketing?

BCG predicts that fintech will become a $1.5 trillion industry by 2030.

Fintech marketing uses strategies and tactics to promote fintech products and services; including, but not limited to: online banking, digital payments, peer-to-peer lending, and robo-advisors.

There are three key marketing aims to driving business growth in this sector:

-

Creating distinct awareness

-

Attracting the right customers

-

Building trust in these tech-driven financial services

But, fintech is a complicated topic that can confound the average consumer. It has complex terms and unknown service offerings.

It is a fintech marketer's job to break this down and generate excitement and creativity in a competitive market.

In this blog, we examine the basics of a fintech marketing strategy and its key components.

What is marketing?

"Marketing refers to any actions a company takes to attract an audience to its products or services through high-quality messaging. Marketing aims to deliver standalone value for prospects and consumers through content, with the long term goal of demonstrating product value, strengthening brand loyalty, and ultimately increasing sales." Hubspot

The fundamental purpose of marketing is to attract relevant target audiences through engaging messaging. The messaging should be informative and educational, assisting with the buyer's journey, helping the customer convert.

Marketing entails various different activities off the back of product development, market research, PR, sales, and customer service.

It is needed at all stages of the sales funnel. It involves numerous platforms, social media channels, and skilled teams to identify the correctly target customers, amplify brand awareness, and build brand loyalty.

What is fintech marketing?

You could say that fintech marketing is just marketing tailored for fintechs, but this is where you are wrong!

Fintech marketing is where you demonstrate your knowledge and experience of really knowing your industry. Your content, relationships, and reputation are all underpinned by your marketing process.

So what does a fintech marketer have to consider...

The fintech industry

Fintech has come on a long evolutionary journey.

From the laying of the transatlantic cable in 1866 to the disruptive innovations emerging after the 2008 global financial crisis.

The term ‘fintech’ (or 'financial technology') was first coined in 1971. This set the stage for the industry’s modern developments.

Mobile devices, cloud computing, big data analytics, machine learning, and artificial intelligence now offer the means for creative, user-friendly, and affordable financial solutions for customers.

And companies like Venmo, Klarna, Stripe and Revolut are commonplace.

The industry has also diversified into areas like InsureTech, PropTech, and blockchain - offering innovative and cutting-edge solutions to the ever evolving market.

Fintech marketing strategy

A fintech marketing strategy serves as a guiding framework for a fintech’s marketing efforts. It offers a vision, principles, and objectives.

Fintech marketing strategies can vary greatly according to competition and target audience.

Fintech marketing originally focused on differentiating itself from traditional financial institutions. But evolving trends require new bold branding approaches.

New branding and marketing trends are emerging with an increased frequency. It's important to have a clear strategy to be able to decipher through them all.

Business-to-consumer (B2C) vs business-to-business (B2B) fintech marketing strategy

The core differences lay in the target audience, decision-making processes and marketing channels:

Target audience

B2C targets individual consumers. The focus is on addressing consumer's personal needs, preferences, and pain points.

B2B on the other hand targets businesses. The audience is the key decision-makers within businesses. They assess the value and utility that the fintech solution can provide.

Decision-making processes

Decisions in B2C are often made by individuals. They can be influenced by factors such as:

-

User experience - A user-friendly website or fintech app is the key to engaging customers. If you provide a poor user experience, they are unlikely to want to engage with your product and/or offering.

-

Simplicity - If a financial tool is difficult to use, it may deter customer's from wanting to use the product.

-

Direct benefits to the consumer - Customers often seek out direct benefits, like cash back, from their financial provider. Fintech marketing campaigns should showcase what benefits fintech's offer their consumers.

B2B decisions involve a group of business stakeholders. Considers may include:

-

Scalability - Does the fintech solution allow the business to scale globally? If a merchant, for example, is looking to operate across multiple countries, they'd be looking for fintech firms that broadcast that.

-

Cost - All businesses want to keep costs down to a minimum. There are various fintech content marketing options that can help minimise costs whilst maintaining outreach.

-

Integration capabilities - Key stakeholders want assurances that the fintech company will be able to integrate and work alongside other fintech services they may already be involved in.

-

Overall business impact - Showcase the value that the fintech company offers. How it is going to positively impact a businesses growth and development.

Marketing channels

B2C often utilises channels that directly reach individual consumers. Such as online advertising, social media marketing, and influencer marketing.

A fantastic modern example of this is when Klarna launched the 'That's smooth' influencer marketing campaign with Paris Hilton back in March 2023.

B2B involves more corporate channels that are targeted directly to businesses. These as industry events like Money 20/20, professional networks like The Payments Association, and specialised trade publications like Fintech Finance.

Social media platforms like LinkedIn are also particularly popular in B2B fintech marketing.

What is influencer marketing ?

Sprout Social describes influencer marketing as a type of social media marketing that uses endorsements and products mentions from influencers.

A growing number of fintech companies have turned to influencers to launch and establish their brand.

Autonomy and creativity

B2C fintech marketers usually have more autonomy and creative freedom. They focus on appealing to individual consumer emotions and preferences.

B2B is more structured and may require alignment with the formal decision-making processes within businesses. This can stifle creative freedom.

There is also the danger of becoming to focused on the tech features of the product - and not telling a compelling story.

Components of fintech marketing

1. Branding

Fintech branding covers everything from identity, image, awareness, equity, communication, and management - just to name a few!

Its uniqueness lies in how it relates to fintech audiences.

Branding has common features across all industries. But deeply understanding a particular industry is a prerequisite for branding in itself.

Fintech is a fast-changing part of the financial services industry. So branding for it can be challenging.

Specialist terminologies, complex concepts, and frequently changing regulations must be considered. Fintech marketers should regularly update their knowledge of them.

The art of growing a fintech brand, as well as other industries, is dependent on being distinctive and memorable, rather than just differentiated.

2. Copywriting

Copywriting is a skilful craft. Compelling text guides customers through the marketing funnel, enhancing conversion rates.

The copywriting process includes research, the writing itself, editing, proofreading, and revision (sometimes multiple!) to ensure the piece is well-written and engaging.

There are a broad range of different types of copywriting; including thought leadership pieces, SEO, blogs, email newsletters, and PPC.

Good copywriting is the secret ingredient to successful marketing. Yet, to write top-notch copy you need a solid guiding framework.

What is a content marketing strategy?

A content marketing strategy helps attract, engage, and build loyalty with an audience through the creation and sharing of relevant blogs and articles.

It also extends to other digital marketing content including videos, podcasts and other media.

3. Search engine optimisation (SEO)

Fintech SEO is a specialist discipline. (Hint: We are actually pretty good at it)

When neglected, businesses run the risk of getting seriously behind.

It can consistently bring a number of highly qualified leads to your website. But SEO can be hard to keep up with.

In our experience as a fintech marketing agency, we've seen that many marketers find that SEO is a mine-field populated with different areas (ranging from technical SEO, on-page SEO, and off-page SEO), differing strategies, jargon, and sometimes even contradictory advice.

Specialist considerations must be made when creating a SEO strategy for different industries - especially fintech.

4. Advertising

Ad campaigns are a powerful tool. When done right, they can captivate the attention of your target audience.

Global payments company Nuvei partnered with Ryan Reynolds recently. He invested in Nuvei back in 2023. He then proceeded to front an advertising campaign called 'It's time for a payments company from Canada'.

They produced a comical series of four videos that parodied Canada's culture, values, and style of business compared to it's North American neighbours.

Nuvei has used this campaign as a starting point to bring in elements of humour to their brand messaging across all marketing channels.

This is a clear example to where humour has been demonstrated in order to bring a fresh approach to B2B fintech advertising.

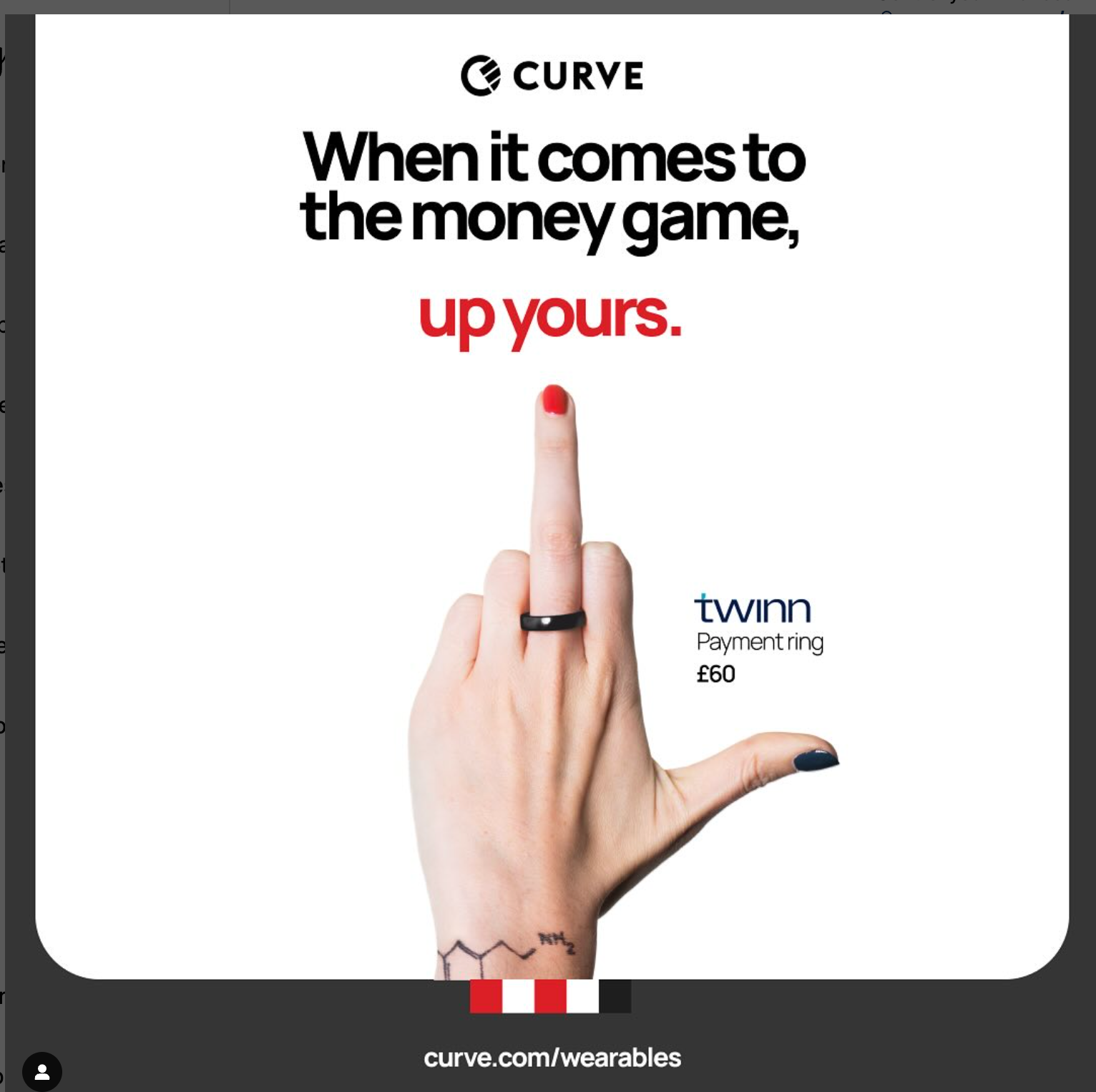

It is typically seen more in the B2C fintech space. Take a look at this hilarious example from Curve as part of their payment wearables campaign.

5. Social media

Social media marketing is a no-brainer for fintech startups, scale-ups, and enterprises.

The marketing strategy involves leveraging social media platforms - whether that be LinkedIn, X, Facebook, TikTok, or Instagram - to boost brand awareness and increase overall conversions.

Choosing the right platform, based on the business's USPs and target audience, is key.

For example, channels such as TikTok and Instagram will only deliver positive results if you have a bank of visual or video content to consistently posts. More often than not, these channels are generally utilised when engaging with B2C customers.

However, NatWest has branched out from its traditional social media marketing endeavours, increasing its investment in TikTok, using social media to leverage a wider range of customers.

6. Pay-per-click (PPC)

PPC is an online advertising model in which fintechs pay a fee each time one of their ads is clicked by a user.

Essentially, it is a way of buying visits to a desired webpage rather than organically earning them through SEO.

At a top level there are two types of PPC: Search and Social.

What is the difference between PPC Search and PPC Social?

The principle of PPC remains the same across all platforms, but there are distinct differences between search and social.

PPC search involves search engines like Google or Bing. Ads are displayed at the top of a search engine results page (SERP) based on a users search enquiries, which target specific keywords in search results.

PPC social, on the other hand, involves social media platforms like Facebook or Instagram. Ads are placed on social media users feed based on their demographics, interests, and behaviours within the social network.

PPC social generally remains the more expensive of the two, with social ad spend representing 33% of a company's overall digital marketing budget.

Both are great tools which can accelerate your fintech marketing campaign results when looking for a quick return on investment (ROI). But it's important to note than costs can quickly add up when lacking a tactful keyword strategy and careful sending parameters.

7. Email marketing

A customer's email address can be the 'Holy Grail' for many businesses. It unlocks the ability for fintechs to legitimately and directly market to them.

Email marketing allows businesses to directly reach their target audience, nurturing relationships, and fostering customer loyalty through personalised communication.

It is a cost-effective way to promote upcoming or existing products and/or services, drive website traffic, and generate leads - yielding a high return on investment (ROI).

However access to fintech customers' social media profile or mobile number, can be equally as valuable, especially when it comes to mobile banking.

8. Event advertising

Event advertising comes in many forms, from hosting a stand to sponsoring the event itself.

When carefully selected, event advertising can offer businesses a unique opportunity to engage with a highly targeted audience in an interactive setting (whether that be face-to-face or virtual), foster meaningful connections, and build brand awareness.

Events provide fintechs with a platform to showcase their products and services firsthand, which can drive immediate interest and initiate potential conversions.

Money 20/20 is one of the highest profile payments events in the global money ecosystem - every fintech wants to be there!

From detailed analytics to expert speakers, the event provides world-class insights and networking opportunities, enabling financial institutions to stay ahead of the curve. The event hones in on what's next in the world of payments, fintech, and financial services.

It's important to remember that there are other forms of media that should be considered alongside the actual event itself. This includes, but is not limited to, social media promotion, merchandise and collaterals, video marketing, and graphic design.

Blue Train Marketing: A fintech marketing agency

Blue Train Marketing is a fintech marketing agency solely dedicated to your sector.

We see ourselves as an extension of your company's fintech marketing team or as an option for outsourcing when rapidly boosting your fintech marketing efforts - whatever you need us for.

We have decades worth of industry experience, meaning we have an in-depth understanding of the industry as well as the technical jargon and regulatory compliance that comes with it.

Conclusion

Fintech marketing promotes a broad range of financial offerings from online banking and digital payments to peer-to-peer lending and rob-advisors, all with the strategic goal of generating brand awareness, attracting customers, and building consumer trust.

The complexity of the sector requires marketers to really break things down, in order to simplify more challenging concepts and excite customers.

A powerful fintech marketing strategy encompasses everything from branding, copywriting, SEO, advertising, social media, PPC, email marketing, and event advertising.

Depending on the target market, B2C strategies will need to provoke individual needs and emotions; whilst B2B focuses on business's scalability, cost, and integrations.

Fintech marketers must stay ahead of the curve - emerging payments trends demand for bold branding approaches.